The market indicators associated with identifiers 7177263148, 640100132, 621126960, 66317868, 21715031, and 484774907 reveal critical insights into current economic dynamics. Trends suggest a complex interplay between volatility and inflation. Understanding these factors can enhance investor strategies. As the landscape evolves, the implications for businesses and investors become increasingly significant. The next steps in adapting to these changes are vital for future success. What lies ahead for those who can anticipate these shifts?

Overview of Key Market Indicators

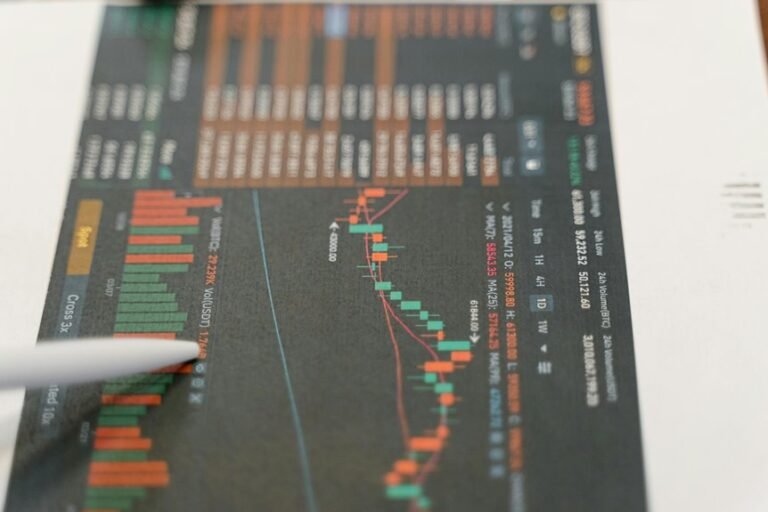

Market indicators serve as essential barometers for assessing economic health and guiding investment decisions.

Key indicators, such as market volatility and inflation rates, reflect underlying economic dynamics. Fluctuations in these metrics can signal shifts in consumer confidence and investment opportunities.

Investors seeking autonomy must remain vigilant, interpreting these indicators to navigate potential risks while capitalizing on market conditions that align with their financial goals.

Analyzing Economic Implications

Economic implications derived from market indicators provide critical insights into broader financial trends and potential future developments.

Analysts utilize these indicators to refine economic forecasts, assessing the impact of market volatility on various sectors.

Understanding these implications enables stakeholders to navigate uncertainties, make informed decisions, and adapt strategies in pursuit of economic freedom, ultimately fostering resilience in an ever-evolving financial landscape.

Investor Sentiment and Behavior

Understanding the factors influencing investor sentiment and behavior is vital for deciphering market dynamics.

Investors often gravitate toward bullish trends, driven by optimism and confidence, leading to increased buying activity. Conversely, bearish patterns emerge when uncertainty prevails, prompting selling and risk aversion.

Analyzing these sentiments allows for a clearer understanding of market fluctuations and potential investment opportunities, reflecting the ever-changing landscape of investor psychology.

Future Trends and Predictions

As the global landscape continues to evolve, emerging trends and predictions are increasingly shaped by technological advancements, regulatory changes, and shifts in consumer behavior.

Future technologies are anticipated to drive notable market disruptions, fostering innovation across various sectors.

Businesses that proactively adapt to these changes will likely gain a competitive edge, while consumers will increasingly demand transparency and sustainability in their choices.

Conclusion

In conclusion, the identified market indicators serve as a compass for navigating the complex economic landscape. As businesses adapt to technological advancements and regulatory shifts, they position themselves for growth amid volatility. Investors, akin to skilled navigators, must interpret these indicators to steer their strategies effectively, capitalizing on opportunities while mitigating risks. The evolving market conditions present both challenges and prospects, underscoring the importance of vigilance and adaptability in achieving sustained success.